Ministry of Justice Consultation – Interest on Client Account Scheme

Ministry of Justice Consultation – Interest on Client Account Scheme

Consultation Response provided by PKF Francis Clark

Synopsis of observations:

We do not support the ILCAS scheme for reasons explained in our consultation response below. We would summarise key concerns as follows:

- INFLATION – The scheme will result in the cost being shouldered by working families and small businesses in the form of increased costs of legal services.

- RISK TO CLIENT MONEY – The scheme will create an increase in instances where client money transactions take place outside of the protection of a client account placing most vulnerable consumers of legal services at the greatest risk.

- INEFFECTIVE IN RAISING REVENUE FOR MOJ / GOVERNMENT – accounting for the lost tax revenue from the reduction in law firm profits, client funds held outside client accounts in future, and the cost of administration we do not believe this scheme will lead to a meaningful increase in revenue for Government. It is also probable that MoJ budgets would be reduced in time to reflect the revenue received under the scheme meaning no further investment in the justice system.

- INEQUITABLE IMPACT – The scheme will most significantly impact consumers of high street law firms. Those consumers accessing services such as conveyancing, probate and private client advice will be greatest hit. These are consumers of legal services who are least sophisticated consumers of legal services and least able to shoulder the increased costs. These areas of law are also arguably areas that place the least demand on the infrastructure of the justice system which the scheme is purporting should be supported by law firms.

- FINANCIAL FAILURE OF LAW FIRMS – History shows that when interest profits are removed from law firms we see increases in financial failures. This will lead to increased risks to client funds, costs of intervention into law firms, disruption in services to the consumer and the loss of jobs.

- ACCESS TO JUSTICE – Many law firms delivering public funded legal services rely on the cross subsidy from client interest income to make these services viable. Whilst firms will be reluctant to cease to provide those services the loss of this cross subsidy is likely to force their hand in these decisions leading to a further extension of the legal aid deserts currently experienced in the UK.

Questions from consultation:

- Do you have any views on the proposed scope of the scheme?

We have provided our views on the scheme in a detailed response below. We thought it was important to set the context of both our firm and the history of the legal sector financial performance and the role of client money in the business firm model as part of our response to ensure the reader receives a full picture of the position that consumers will face if the proposed scheme is progressed.

- Background information the responder to this consultation – PKF Francis Clark

PKF Francis Clark is a top 20 UK accounting firm employing over 900 individuals with a group turnover in the region of £85million.

One of our teams specialise in advising law firms. On an annual basis that teams work with over 200 law firms across the UK. These firms represent a cross section of the legal sector both geographically and in terms of size and nature of the law firm.

We have a team of over 50 people who provide advice to law firms, and they spend almost all their time advising law firms. Our team has been established for almost 30 years.

We provide a full range of advice to law firms including accounting, audit, client money compliance, taxation, structuring, transaction, training, and profit improvement services.

We author a range of annual financial benchmarking surveys in the legal sector including the NatWest Legal survey, the LawNet group survey as well as supervising the delivery of the Law Society annual financial benchmarking survey.

We have individuals who serve on both the Law Society Leadership and Management Committee and the ICAEW Solicitors Interest group.

We are authors of the current edition of the Law Society’s guide to the SRA Accounts Rules.

Over the last 30 years we have worked closely with various regulators in the legal sector and have a long history of being involved in the evolution of the regulation of client money in the sector.

- History of interest income in the legal sector

In the UK law firms earn interest on the monies they hold in client accounts in relation to the legal advice they provide. The monies held relate to both reserved and non-reserved legal services that they provide. The treatment of the receipt of these funds and any payments to clients in lieu of interest earned are determined by the rules of their regulator.

In England and Wales most law firms are regulated by the SRA and our comments in this response (where referencing accounts rules) relate to the current rules in place with the SRA.

However we should be cognisant that the rules for firms operating in Scotland and Northern Ireland vary to those of the SRA and of course there are some other regulators where the rules for receipt and management of interest on client monies will also differ.

Historically when the Law Society of England & Wales regulated client money there were prescriptive rules which determined how much should be paid to clients in lieu of the interest when a law firm earned interest on a general (pooled) client account. It also required all interest on Designated Client Accounts (DDAs) to be paid across to clients.

Under the existing primary regulator in England and Wales (the SRA) firms operate under an outcomes focused regime where they have an obligation to account to the client for “a fair amount” in lieu of interest.

Law firms are required by the SRA to have an interest payment policy. This must be fair, transparent and clearly communicated to clients. Whilst the nature of these polices vary between law firms many broadly stipulate that clients will receive interest at a rate, they could otherwise secure from the same level of funds being held in an instant access account if they held them personally and subject to a de-minimis of between £20 and £50.

If we consider a general (pooled) client account, the law firm usually retains an element of interest over and above the amount they pay to the client. This is simply because the law firm can commercially earn a higher rate of interest on the total balance in the general client account than the client could earn from an instant access account from the same amount. The point being that the client has still earned interest at a level which they could have earned if they had retained the monies in their own bank account.

Before 2008 (when we saw interest rates falling from 5.75% to an historic low of 0.5% in a very short period) it was very common to see law firms where substantial amounts of their profits were generated from client account interest income. Specifically before 2008 it was common to see interest income profits representing between 33% to 50% of law firm reported taxable profits.

It is also worth observing that in the years following 2008, that is 2009 to 2011, there were a significant number of financial law firm failures which arose from the abrupt removal of client interest income from the law firm business model. In that period law firm transactions for consumers were disrupted and high street prices of law firm services rose significantly to adjust for the loss of this income.

We therefore have not just supposition, but a clear history of events as to the role client interest income has played in the law firm business model and the impact on consumers when that income stream is removed.

- Changes since 2022

In the period 2008 to 2021 the law firm model adjusted to consumers paying more for legal services.

Since 2022 base rates returned to their longer-term average reaching 5.25% at the peak. For many law firms this should have resulted in several years of super profits in their business, but the reality has been quite different.

We must remember that since 2022 there has been some significant inflation in the economy and even higher inflationary pressures in salaries within law firms. Demand for legal services has been strong but supply of fee earners to undertake this work has led to high inflation in salaries peaking in 2022 and 2023 with regular headlines on the issue including those paid to newly qualified solicitors.

Law firms have needed to meet the salary demands to ensure recruitment and retention of people but at the same time they have not applied the same inflationary pressure on fees to their clients.

This inflationary pressure has not been needed because it has been the client interest profits in law firms which has subsidised the inflation in salary costs rather than inflation in fees. So the return of client interest profits to the law firm business model has served the effect of insulating consumers from high inflation in the production of their services.

- Composition of the UK legal market

There is a good deal of information available on the composition and structure of the UK legal market. In broad terms there are around 9,000 law firms in the UK. Most of these law firms are very small, and it is only the top 200 law firms where the income and size of the firm is more substantial.

In context at around the top 100-mark firms have a turnover in the region of £50million, at the top 200 this drops to around £15million. So for around 98% of law firms their turnover is significantly less than £15million – further data would show the majority of law firms are small or micro businesses with turnover of less than £1million.

It is important to also appreciate the difference across the legal sector in terms of the legal services these businesses provide. Most UK law firms outside the top 200 firms are dependent on a relatively narrow range of legal services. For example, the turnover composition of a typical firm derives from the following broad work types:-

Residential Property 25%-35%

Commercial Property 10%-15%

Probate, trusts & estates 35% - 40%

Family 10% - 15%

Litigation 10% - 15%

Commercial Property 10%- 15%

The top 100 firms often have a very different mix of work to mainstream firms, and they also have a very different mix of clients. As law firms become larger their income streams are often dominated by different work areas including:-

- Complex litigation

- Public Sector

- Corporate and commercial

- International

Clients buying legal services from firms outside top 100 are more commonly private individuals (working families) and small businesses.

In contrast in the top 100 many law firm clients more often will include large corporates, public sector, international businesses and high net worth individuals.

There are two important points to draw from this analysis.

-

-

- The nature of consumers engaging with firms outside the top 100 are often less sophisticated and less regular purchasers of legal services. The protections afforded to those consumers by the client account are arguably more important than to those consumers (e.g. corporates and the public sector) accessing legal services from larger law firms.

- The volume of client funds held by the law firms outside the top 100 are proportionately higher than larger law firms because of the nature of the work they undertake and because the consumers rely on the law firms more to undertake the financial element of the legal transaction.

-

We explain further in this response that we are concerned that ILCAS will have the impact of interfering in a long-standing business model and that this will ultimately only have the impact of creating significant inflation in legal fees for consumers.

We also believe that the consumers most affected by the price rises will be those least able to pay and that the burden will ultimately be shouldered by working families and small businesses.

We also believe there is a strong probability that more client money will, legitimately, be held outside of a client account in the future and this will impact on the most vulnerable members of society who rely most on the protections provided by client accounts.

- Statistics on client interest income

We believe the statistics set out in the consultation as provided by the Ministry of Justice (MoJ) are not representative of the reality in the legal sector.

At PKF Francis Clark we see financial information from around 200 law firms each year. We are also able to analyse the results of independent national legal sector surveys we are involved with on an annual basis. All this information presents a very different picture in relation to client account interest income to those set out in the consultation.

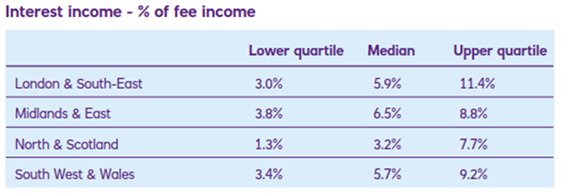

There are two important elements of information to consider here and to illustrate the points we will use the results from the 2025 NatWest financial benchmarking survey which we compile on behalf of NatWest.

The NatWest legal survey is a very good representation (statistically) of the UK legal sector – in includes around 110 law firms and range from small firms with a turnover of £1m up to top 50 firms with turnover exceeding £200m. The average firm reported turnover of £17m.

-

- Interest income profits as a % of earned income

These results immediately show us that interest income receipts are a significant element of the law firm financial model with 25% of firms reporting that it exceeds nearly 10% of their revenue.

-

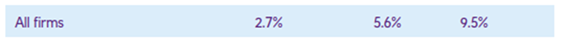

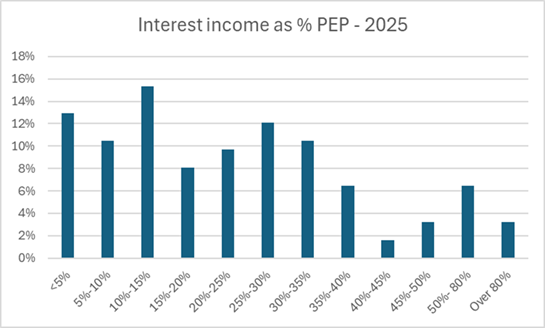

- Interest income profits as a percentage of law firm profits (or PEP)

Law firms will often compare financial performance by consider the profits per owner/partner (PEP). In effect the profit of the firm divided by the number of people who share those profits.

We can see from the results below how significant interest income profits are compared with a firm’s total profits.

If we consider the distribution of data for interest income as a percentage of law firm profits, we can see that for 50% of firms interest income represented between 9% and 35% of their profits and for most firms it represents at least 20% of their profits.

We can also see for around 9% of firms over 50%, and in nearly 4% over 80%, of their profits are interest income profits.

All these results are consistent with our own experience of the clients we work with in the legal sector.

The consultation appears to have asked law firms whether they are “dependent” on client interest income, and it then implies that interest income is not a “big issue” to law firms. This is totally misrepresentative of reality.

The underlying facts are:

- For Top 100 (and particularly top 50) firms interest income profits are indeed negligible in their financial models.

- For the other 8,900 law firms (or 99%) of the legal sector interest income can play a very significant impact in their financial model (as it did pre-2008).

- For a typical top 50 law firm interest income represents less than 0.1% of their turnover. Outside of the top 50 this rises to around 6%. In some firms it can be as high as 15% of their total turnover.

- For a typical top 50 law firm interest income profits represent less than 1% of the profits. Outside of the top 100 this rises to 20%-30%.

- Financial failure in the legal sector

Considering the statistics presented above and the actual experience in the legal sector in 2009-2011 it feels inevitable that ILCAS would result in a significant increase in the instances of financial failures in the legal sector.

Whenever financial failures arise in the legal sector client funds are placed at a higher risk. This statement is consistent with studies issued by various legal regulators over several decades.

With financial failure comes the need for regulatory intervention to protect the continuation of client matters and protect client funds. This naturally creates additional costs which ultimately would be suffered by consumers in higher prices.

Publicly available information suggests that regulators are struggling with current levels of interventions required. It is important therefore to understand the extent of strain that significant financial failures would place on the protection of client funds in the legal system.

Joining up these comments it is almost inevitable that client funds will face higher risk if ILCAS is introduced, the regulator will face enormous pressure in managing the rise in interventions and the consumer (through increased regulatory costs to the law firms from those interventions) will face even more inflation in the cost of legal services.

- Impact on consumers from ILCAS

- Risk to their client funds will increase

It is probable that law firms will seek to hold more client money (legitimately) outside a client account.

This might enable firms to offer clients two price options if ILCAS is introduced – one which involves the use of the client account for their reserved legal service and one which does not. Whilst the law firm will need to be clear with the client about the risks of not using the client account the SRA Accounts Rules allow firms to take this route if the client is fully informed and consents.

In many cases where clients are facing the option of a higher cost option with the use of regulated client account and a lower price without regulation, we believe consumers are likely to select the cheaper option.

The outcome is that those consumers who most need the protection of a client account will often not receive this protection any longer.

It is tempting to assume of course that the approach of holding the funds outside of the protection of a client account would mean that the consumer would benefit from earning all the interest on the client account but the reality is that firms would simultaneously commercially also deploy increases in cost to assist the consumer in their transaction via a non-regulated account.

Firms will of course need to be cognisant of the overarching Standards and Regulations. Principle 7 requires the firm to act in the best interests of each client, balancing the cheaper cost with client account protection, and both codes of conduct that require safeguarding of client money and assets. For these reasons it is probable that the use of a clients’ own account may be more favoured by firms if this approach is adopted on a widespread basis. Ultimately of course a consumer is totally within their rights to undertake the financial element of transactions in their own right with the support of the law firm.

- Increases in cost of legal services

The statistics available in the legal sector inform us that many law firms will need to increase their charges to clients if the ILCAS is implemented to either financially survive or to justify continuing to provide various legal services.

These costs that may present themselves to consumers arise in various ways including hourly rate increases, fixed fee increases or specific charges where a consumer uses the law firm’s client account.

Either way this will be an additional burden to the consumer and of course (for non-VAT registered consumers) the burden would be further increased by 20% VAT on the fee being raised. Again most likely to lead to the burden being shouldered by working families and small businesses.

- Inequalities in the burden of increased costs

We have explained that law firms most impacted by these changes will be those who provide mainstream legal services to the working families and small businesses (e.g. residential conveyancing and probate / estate services).

Consequently those consumers who are least able to pay additional costs for legal services and those that are least well positioned to understand the risks associated with client money will suffer the costs.

- Where must law firms hold client money?

We explain later in this response that firms can legitimately hold money relating to reserved legal services outside a client account where the client is informed and enters the arrangements voluntarily.

We have explained that we would anticipate that this practice would become more widespread if ILCAS was introduced and this would reduce protections to the most vulnerable users of the legal system.

The client may well be presented with two price options – including one which is substantially lower if the money is held in the firm’s business account rather than the client account.

Of course the law firm would need to be totally transparent with the client about the relative risks of holding their funds in an unregulated business account; subject of course to the points raised in g(i) above.

However an average consumer looking at the price differential and perhaps seeing a law firm that has existed for say 200 years and always advised their family are highly likely to be tempted by the lower cost option.

- How much revenue is likely to be raised for Government from an ILCAS?

We must remember that at present the profits from interest income which the ILCAS scheme will receive are currently subject to tax in the law firms.

For simplicity just looking at the LLP / partnership scenario, these profits are often subject to tax at 47% (45% income tax and 2% National Insurance). Let’s for simplicity say 50% (noting it could be higher if a company is used and profits are extracted at higher or marginal rate tax rates). So, whatever amounts are passed to ILCAS only around 50% could ever be a net gain for Government tax revenue due to the lost income tax from the firms profits which no longer exist.

If we then consider the probable reaction to ILCAS from law firms and consumers, the cost of delivering and administering a scheme and the possible budget restrictions Government may then apply to future allocations to the MoJ it seems highly likely that the impact of ILCAS in generating a meaningful contribution to supporting the justice system is likely to be negligible.

It would simply increase the cost of legal services to working families and small businesses and push more funds into un-regulated bank accounts.

- Inequalities arising from ILCAS

The consultation outlines almost a moral obligation for the legal sector to further fund the justice system from which it benefits.

Even if we assume this is a reasonable proposition it seems clear that this is still inequitable as a mechanism to achieve this. It places the burden of funding on the smallest law firms serving the more vulnerable people in society.

Does a firm delivering conveyancing services, for example, use the justice system more than a high-end litigation firm accessing the courts every day but holding negligible client funds? The point here is not determining “who should pay” but making the point that this is a blunt and inaccurate way to ensure the “user pays” in terms of who really benefits from a strong justice system.

A final and important observation which is explored further in our response below is the impact on providers of public funded services and ultimately the access to justice for the most vulnerable sections of society.

The ILCAS is almost inevitably going to lead to a notable reduction in the number of firms that provide public funded work because at present with existing Legal Aid rates, in many cases, law firms can only provide those services because of the cross- subsidy interest income profits they earn from the client funds held on their private client work.

- Aside from reserved legal activities, is there other work undertaken by legal service providers that includes holding client money? Should this be in or out of scope of the scheme?

As set out elsewhere in this response law firms may hold client money outside a client account. It may be held in the clients own account (i.e. mixed in with personal money of the client), in fact it may be held in any account the client mutually agrees (with informed consent) with the solicitor (including the law firm’s own business account).

Equally of course there is nothing to stop a law firm assisting the client in making financial transactions from their own account without the solicitor being involved thereby avoiding entirely the use of the client account or any direct involvement from the solicitor.

The point is that this is not a desirable outcome because client accounts afford consumers protection and many clients are unable to safely undertake the financial transactions that law firms manage on their behalf. Again, this would seem to impact the most vulnerable of consumers accessing legal services, some of which may not have a bank account.

The cost of ILCAS will encourage financial transactions that currently take place within the protections of a client account to be moved to an unregulated position. So in addition to increasing costs to consumers it will place those consumers least able to understand the legal system and financial transactions at an increased risk.

- Are there other account types used for holding client money that should be in scope of the scheme?

As set out in the response to question 2 above consumers can agree with the law firm that their funds are held outside a client account.

Rule 2.3(c) of the SRA Accounts Rules enables, with informed consent, for transactions involving reserved legal activities to be undertaken with the funds relating to the transaction being held in a non-client account. This may therefore, for example, be in the law firm’s office account or a clients’ own account.

Of course the scope of the ILCAS would not cover interest earned on those accounts but perhaps more importantly the clients would also not be afforded the protection which is associated with a client account.

Rule 2.3 is extracted below for completeness:-

“You ensure that client money is paid promptly into a client account unless:

- in relation to money falling within 2.1(c), to do so would conflict with your obligations under rules or regulations relating to your specified office or appointment;

- the client money represents payments received from the Legal Aid Agency for your costs; or

- you agree in the individual circumstances an alternative arrangement in writing with the client, or the third party, for whom the money is held.”

In addition Rule 2.2 which is set out below provides for certain circumstances where firms can legitimately hold funds reserved for the settlement of their own fees outside a client account. Many law firms do not currently take this exemption but with the introduction of an ILCAS it seems probable that more law firms will follow this approach thereby reducing any interest earned that would be available to such a scheme.

“In circumstances where the only client money you hold or receive falls within rule 2.1(d) above, and:

-

- any money held for disbursements relates to costs or expenses incurred by you on behalf of your client and for which you are liable; and

- you do not for any other reason maintain a client account;

you are not required to hold this money in a client account if you have informed your client in advance of where and how the money will be held. Rules 2.3, 2.4, 4.1, 7, 8.1(b) and (c) and 12 do not apply to client money held outside of a client account in accordance with this rule.”

Of course this rule / exemption is only available if this is the only type of money a firm receives from all clients. If the firm undertakes any work for any client that involves other funds (e.g. estate money, mortgage advances, damages etc.) then this option is not available.

However for those firms who currently decide to continue to afford the protection of a client account in these circumstances it is probable those firms will reconsider this position in the future.

- Are there any types of individual account used for holding client money that should not be included in scope of an ILCA scheme? And why?

For the reasons set out in question 1 we do not believe the scheme is appropriate and so we do not believe any account holding client money should be subject to such rules.

In question 2 and 3 we have outlined some of the practical issues involved here and the likely repercussions of ILCAS.

It is entirely inappropriate that firms who account to their clients for all the interest income earned on client account (whether pooled or in DDAs) should then be required to account to the ILCAS for the same funds.

- We propose that the scheme retains a higher proportion of interest generated on pooled client accounts (75–100 percent), and a lower rate of 50 percent of interest on individual client accounts. Do you have any comments on these rates?

The consultation refers to “individual client accounts”. We assume this refers to Designated Deposit Accounts (or DDAs as the sector often refers to). DDAs can either be individual accounts, or they can be pooled DDAs where the amounts attributable to individual clients (and interest earned on those funds) can be separately identified. These along with pooled (or general) client accounts represent the types of client accounts held by most UK law firms.

The ILCAS refers to collecting 75% of interest earned on pooled clients’ accounts. There is a practical problem with this in that firms hold funds in their general client account which relates to legal services provided both in relation to reserved and non-reserved legal matters.

Money held in a pooled client account in relation to non-reserved legal matters can for example be held in relation to employment advice, housing advice, will writing, contract drafting, business law, estate administration, advocacy at tribunals, family law advice

Payments on account from the LAA and of course money earmarked for settlement of the firms’ own fees may also be money held on the client account which does not relate to reserved legal matters.

In some cases mixed funds can be held on the same matter for the same client in relation to both reserved and non-reserved legal matters.

We should also consider firms undertaking international transactions. It is not always the case that the funds in the UK client bank account will relate to work being undertaken for the client in the UK. In those circumstances trying to delineate between funds relevant to the UK ILCAS and those which should be excluded would be problematic and disproportionately expensive to identify.

It is difficult to see practically how a firm could in such circumstances calculate the interest income derived from the funds held for different purposes. This point applies equally to pooled accounts and DDAs.

The ILCAS is also referring to gross interest collected on client accounts by law firms and not the profits retained after payments in lieu of interest to clients. This is considered elsewhere in this response but as a practical comment some firms (voluntarily) pay all the interest to clients that they earned on pooled accounts and of course on DDAs almost always all the interest earned to clients (in our experience it would be unusual if this was not the case). So, for those law firms the payment required under ILCAS would force them to stop paying the interest to the clients to fund the ILCAS payment.

- Do you foresee any difficulties with keeping in place the existing rules on client interest, for the interest not secured by the scheme?

Under the SRA Accounts Rules there is a requirement to account to the client for a fair amount of interest under Rule 7.1.

In practice there are varying approaches to this in the sector because it is operated under an outcomes focused environment. For many law firms this means that their interest policy, explained to clients in a client care letter, is that they will account to them for notional interest where the amount which a consumer could otherwise have earned in an instant access account with the same level of funds would exceed over £50. (Some firms offer a de-minimis here as low as £20 and in our experience, it is rare to see a de-minimis applied of over £100).

Noting all the observations we have explained in question 1, under the ILCAS as set out it would be unclear whether firms would continue to take this approach – noting the current requirement is only to pay a “fair amount” of interest to the client.

Firms may adjust this policy and interpretation of “fair” to consider

-

-

- The residual actual interest earned by the firm after payments to the ILCAS and;

- The relative cost of administering client funds

-

We may for example see more firms agreeing with the client that no interest will be payable to them on the basis that the amount retained by the firm is low and the cost of administering client transactions is significant. There would naturally be a need for a client to be clearly informed about any new arrangement under the existing SRA Accounts Rules.

Of course, it would be possible for a firm to agree to continue to pay notional interest to clients as they currently do and then separately agree to charge them a fee for using their client account – for example this might be a flat rate fee or it might be simply the interest they would have otherwise earned without an ILCAS in place.

For the consumer of course this would increase the cost of legal services because they would be paying the cost of interest paid to ILCAS and there would be an additional 20% cost in the form of VAT which would be incurred on the additional fees (where the consumer is not VAT registered or is otherwise unable to recover the VAT on the invoice).

All this would be detrimental to clients that are not VAT registered and cannot recover VAT on purchases. In practical terms, considering earlier comments in this response as to the nature of law firms most impacted by the ILCAS and the type of work those firms undertake it is likely that this would in turn disproportionately impact on working families and small businesses.

- For legal work undertaken on your behalf as a client, have you received (or are you expecting to receive) interest on your funds?

We have experience of receiving a payment in lieu of interest from a law firm on matters we have undertaken.

We also have vast experience of seeing law firms make payments to clients in lieu of interest in accordance with their regulator rules in this area.

- If yes to the previous question, how much interest have you received/are expecting to receive?

Law firms are required to communicate their policy for the payment in lieu of interest. In our experience these policies are very clear for consumers. In most cases as outlined in question 6 above the amount paid is what a client could earn with the same level of funds held in an instant access account from the same bank as the law firm subject to a de-minimis of (usually) £20 to £50.

- Are there any impacts of the proposed scheme on clients that we have not considered?

Yes, we believe there are a wide range of repercussions this scheme has not considered and we have set out our thoughts in our responses to other questions in this consultation.

- For legal service providers: how easy or difficult do you find it currently to open pooled or individual client accounts?

Opening new bank accounts is a complex and time consuming and expensive process for law firms to undertake.

- For client account providers (including Third Party Managed Account providers): are there any benefits or challenges foreseen with introducing banking products with the specified criteria proposed?

We cannot respond as a client account provider but based on past experience on similar issues we would expect there to be significant constraints in this being delivered and we would expect there would be a higher product cost and administration cost to delivery.

This will ultimately mean higher legal costs for working families and smaller businesses and less tax revenue to HMRC.

- For client account providers: Would you be able to offer client accounts that could automatically transfer the appropriate amount of interest to the scheme? How would they work?

We are not a client account provider. Our expectation, based on some initial discussion with banks is that the scheme would be complex and expensive to deliver to law firms.

- By what process should a “comparable rate” of interest on client accounts be determined?

The consultation refers to a comparable interest rate being “….a rate of interest that is comparable to other interest-bearing accounts the bank offers with similar balances.”

We believe that there are a range of practical issues which will make this impractical to implement. We also believe that interfering in commercial pricing arrangements between law firms and banks will have other detrimental repercussions.

The rates set on client accounts are a complex mix of pricing arrangements with a law firm on all aspects of banking and lending services.

Setting rules around this through ILCAS would have an unpredictable impact on these arrangements – it may for example restrict lending available to some law firms that in turn could impact on financial stability of law firms. It would also most likely push up the cost of banking and funding facilities to law firms which ultimately would be inflationary for the consumer.

In practical terms we would also query what would constitute a comparable account. Client accounts are unique in relation to the nature of work a bank must undertake to enable them to deliver the service required.

For example, the cost to a bank of running the bank account of a manufacturing business holding £5million on a reserve account is very different to running a client account for a law firm with an average balance of £5million.

Law firms are attractive to banks for several reasons including the volume of funds held. However law firms are expensive for banks to service because of the requirements and transaction heavy nature of client accounts.

This is a step into Government seeking to dictate the commercial and pricing decisions of both the banking sector and law firms simply to introduce what amounts to an additional tax on legal transactions.

This subject area perhaps gets to the core of the issue here in that the amount a law firm earns in interest on a client account is a complex negotiation of a range of services and financial arrangements for the firm – it is not “unearned income” as the consultation describes it as being.

- We propose that interest is credited to client accounts, and collected by the scheme, periodically (such as monthly or quarterly). What should that frequency be?

Irrespective of the frequency any such scheme that adopts this creates a further administrative burden in the process of delivering legal services. Those costs will be incurred by banks and law firms and will ultimately result in additional costs to consumers.

The cost of administration by the MoJ (or any other area of Government responsible for it) will most likely negate any additional revenue earned for central Government.

- Are there other account criteria for the accounts that would be recommended to make the scheme work as intended?

No comment

- Do you foresee any practical difficulties with the proposed process for legal service providers?

We have set out in other responses a range of issues in implementing the scheme including receipt of mixed funds, existing interest payments to clients, risks of client funds being redirected to unprotected accounts along with other points.

The additional costs of compliance and administration resulting in additional costs of providing legal services, as set out in various other responses, impacting most probably working families and small businesses most significantly.

- Do you have any suggestions for changes that could improve how the model works for legal service providers?

If the MoJ are looking for additional ways to better fund the justice system, there could be merit in looking at an alternative to the proposed scheme which we believe fundamentally, as presented, will be damaging to consumers and ineffective.

The MoJ could consider discussing with the regulators whether the MoJ could in future receive the residual client balances held in law firms rather the current option where law firms are able to donate them to charities in certain situations. Such funds could be redirected to fund, for example, improved rates for legal aid providers to improve access to justice.

- Do you have any other thoughts on the intended scheme process for legal service providers?

No comment

- At your firm, how much interest is typically generated on a single client’s funds including:

a. On one client’s funds in a pooled client account; and

b. On one client’s funds in an individual client account.

Law firms do not capture this type of information in our experience, and it would be time consuming to collate this information.

It would vastly vary on the type of matter being undertaken, volume of funds involved, duration of the matter and the interest policy of the law firm.

The amounts here would also be impacted by wider banking arrangements the firm has – for example sometimes the amount of interest earned on client funds is impacted by the arrangements the firm has with its banking provider in areas such as business debt, banking charges and interest arrangements on the office (business) account.